FIFA’s grand ambition for the 2025 Club World Cup might have collided with reality. The tournament, set to be the biggest iteration yet, is intended to usher in a new era of global club football, featuring an expanded 32-team format hosted across major US cities. But as ticket prices were reduced dramatically, the question looms: did FIFA overestimate the demand for its latest spectacle?

The decision to expand the Club World Cup was positioned as a game-changer. With 12 European clubs, including giants like Real Madrid, Bayern Munich, and Chelsea, alongside South American powerhouses and global contenders from Africa, Asia, and North America, the tournament promised a ‘World Cup of club football.’ The US, with its deep pockets, state-of-the-art stadiums, and FIFA’s growing interest in the American market, was the natural choice to host. But just months before kickoff, signs of sluggish demand suggest that this grand plan may not be unfolding as expected.

Initial ticket prices were nothing short of astronomical. Fans looking to attend the semi-finals originally faced a steep $526 (£423) price tag, while the cheapest seats for the final were a staggering $892 (£717). Recently, FIFA introduced a pricing tier that drops prices for the semi-finals to $140 (£113) and for the final to $300 (£241). Officially, FIFA maintains this is not a price cut but a strategy to “reward fan loyalty.” But the sheer scale of the markdown suggests a different story – one of demand that hasn’t matched the organisation’s lofty projections.

FIFA’s increasing focus on the US market is no secret. With the 2026 World Cup looming, the governing body sees the Club World Cup as a precursor to drum up interest in football’s next big frontier. The logic seems sound: the US has a booming football scene helped by David Beckham bringing Lionel Messi and friends to Inter Miami, the MLS is growing steadily and international friendlies on U.S soil can draw large crowds (Real Madrid vs Barcelona for example). But FIFA may have underestimated the challenge of selling a 32-strong club football competition to an audience that primarily engages with the sport’s biggest names.

While the World Cup in the US sells itself, the Club World Cup is a different proposition. The average American sports fan isn’t necessarily invested in Chelsea vs. León or Manchester City vs. Wydad AC. Club allegiances in the US are fragmented, with a mix of European, Latin American, and local loyalties, making it harder to create the kind of unified enthusiasm.

One of FIFA’s biggest miscalculations may have been its pricing strategy. Football fans, even die-hard ones, have limits to their spending. Expecting them to shell out big money for games featuring clubs that are unfamiliar to a large portion of the American audience, and even the global football audience in some cases, was always going to be a tough sell. Even in Europe, where these clubs have entrenched fanbases, such prices would raise eyebrows. In a country where football still competes with the NFL, NBA, NHL, and MLB for attention, FIFA’s pricing strategy felt more like wishful thinking than sound business sense.

If an organisation wants to grow a sport in a country, it has to make it accessible, especially considering that a lot of U.S. sports fans are already disillusioned with rising ticket prices for their favourite sports. To me, there was a missed opportunity to position football as a more accessible sport and invite a wider audience to enjoy the spectacle.

FIFA has long sought to build a truly global club competition, but history suggests that forcing such expansion rarely guarantees success. The Club World Cup, in its previous and much smaller format, already struggled for mainstream appeal outside of the participating clubs’ fanbases. The competition was often seen as an obligation rather than a prestigious title chase, and the hope was that expansion would elevate its status. Lukewarm ticket sales indicate that this move might not be paying off.

One could argue that FIFA is banking on a long-term strategy—perhaps they don’t expect this tournament to sell out immediately but see it as the beginning of a slow build. But when ticket sales lag this significantly, it raises concerns about whether the format itself needs tweaking. If the focus is long-term then accessibility should have been a priority over revenue generation.

Would a smaller, higher-quality tournament with only the absolute elite teams generate more interest? Or do football fans just not have the desire for another club competition? These are questions FIFA will have to confront sooner rather than later.

As FIFA works to fill stadiums and repackage its messaging around ticket prices, the broader implications are clear. The governing body’s ambitions for the Club World Cup may have been too aggressive, too soon. The US may be the future of football growth, but expecting immediate demand for a month-long club competition, at exorbitant prices, was a gamble that is not paying off – at least not yet.

FIFA has built its empire on grand visions, often pushing boundaries and reshaping the global football landscape. But if this tournament struggles to generate the excitement and turnout it envisioned, it may serve as a stark reminder that even the most powerful football institution in the world cannot manufacture demand out of thin air.

There is undoubtedly a growing interest in football in the U.S. I spend a lot of time there, and the conversation around the sport is far more common now than it was a decade ago. However, the powers that be must be careful not to mistake enthusiasm and attention for a willingness to buy tickets, especially at unreasonable prices.

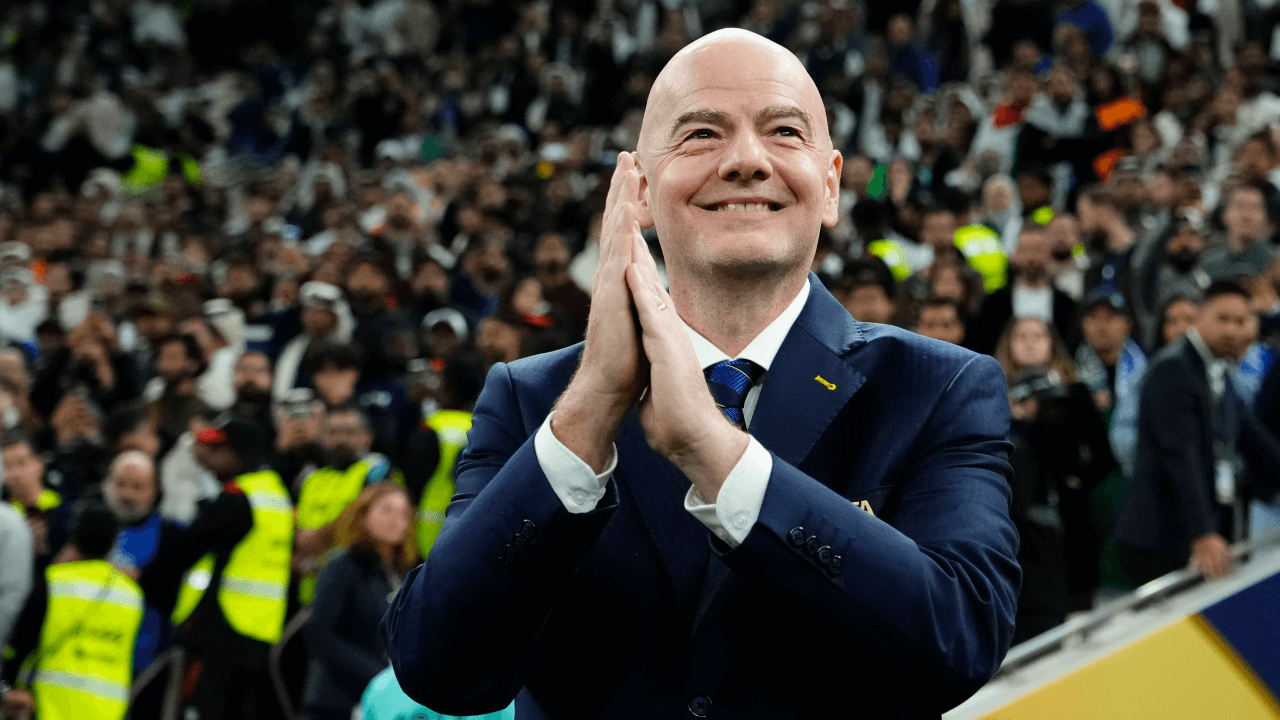

(Cover image from IMAGO)

You can follow every game from the expanded Club World Cup on FotMob – with in-depth stat coverage including xG, shot maps, and player ratings. Download the free app here.